The difference comes from whether you believe in the efficient market theory. In particular that means that if returns increase with book/price, then stocks with a high book/price ratio must be more risky than average - exactly the opposite of what a traditional business analyst would tell you. One thing that's interesting is that Fama and French still see high returns as a reward for taking on high risk They measure the historic excess returns of small caps and "value" stocks over the market as a whole.īy the way SMB and HML are defined, the corresponding coefficients b s and b v take values on a scale of roughly 0 to 1:ī s = 1 would be a small cap portfolio, b s = 0 would be large cap, b v = 1 would be a portfolio with a high book/price ratio, etc. SMB and HML stand for "small minus big" and "high minus low" The "three factor" beta is analogous to the classical beta but not equal to it, since there are now two additional factors to do some of the work. Here r is the portfolio's return rate, R f is the risk-free return rate, and K m is the return of the whole stock market. R - R f = beta 3 x ( K m - R f ) + b s x SMB + b v x HML + alpha

They then added two factors to CAPM to reflect a portfolio's exposure to these two classes: The best known approach like this is the three factor model developed by Gene Fama and Ken French.įama and French started with the observation that two classes of stocks have tended to do better than the market as a whole: (i) small caps and (ii) stocks with a high book-value-to-price ratio (customarily called "value" stocks their opposites are called "growth" stocks). CAPM uses a single factor, beta, to compare a portfolio with the market as a whole.īut more generally, you can add factors to a regression model to give a better r-squared fit. (Besley & Brigham, 2007)The Fama French model supplements the CAPM model to further evaluate the cost of equity in terms of return on. The major reason to use the CAPM model is that the model gives the objective nature of cost of equity, which the model can yield.

Capm eviews how to#

The CAPM gives an ideal situation of how to price securities that are traded in financial markets to determine the expected return on asset. (Bodie, et al., 2009)The section of the report identifies the fact that why should we test CAPM and Fama French Model? The answer is that the CAPM is used to assess the impact on expected return on asset exclusively by the movement in market risk premium. This is the reason Fama French model is referred to as the three factor model. The model considers the fact that whether the small cap stocks and value stocks outperform markets on regular basis. The model adds the size and value factors in addition to the market risk factor in capital asset pricing model. (E (Rm) – Rf)Fama & French model is referred to as the extension of capital asset pricing model.

Capm eviews free#

The risk premium is referred to as the excess ret urn of the market over the risk free return. (Sharifzadeh, 2010) The formula for capital asset pricing model is as followsΒi = Beta, which refers to as the sensitivity of the risk premium to the expected return. Part 2 of the report is based on the audit fees to evaluate whether the firm characteristics explain the cost of audit or not.The capital asset pricing model is referred to as the model that describes the relationship between the risk and return, which determines the appropriate required rate of return on assets.

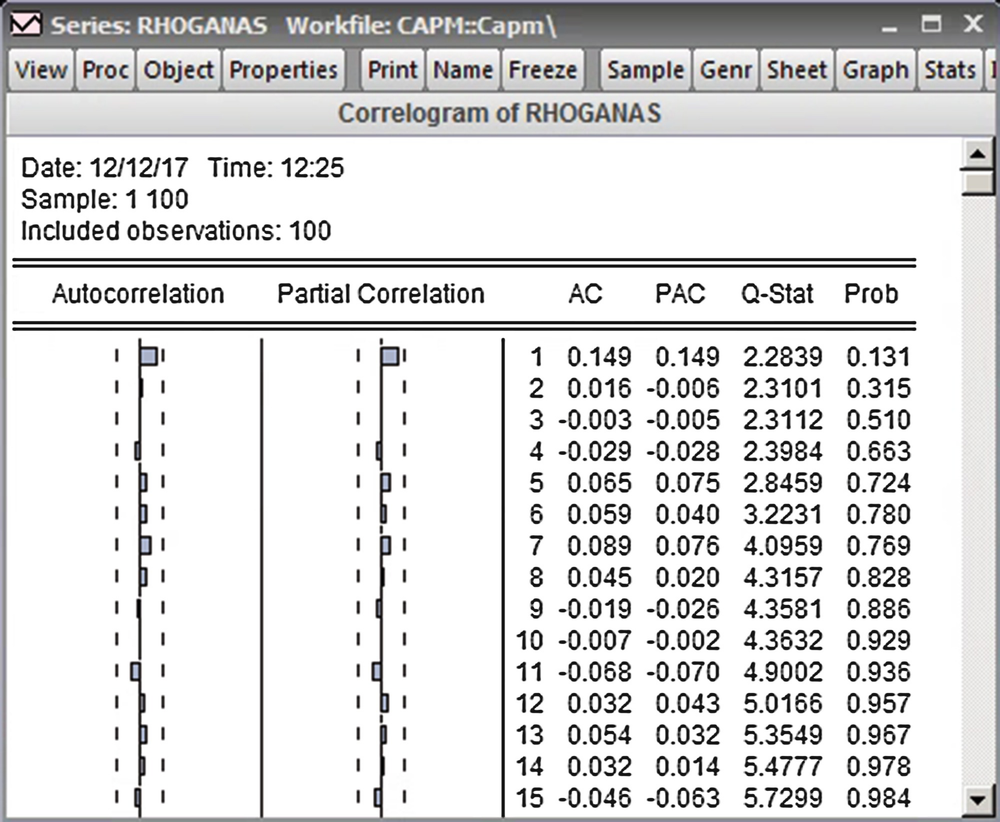

Part 1 is based on the test of Capital Asset Pricing Model and Fama French Model using the factors for US stocks for the period of 1963 to 2013. The report uses the Eviews for the data analysis and hypothesis testing for CAPM & FAMA French Model (Dougherty, 2011)The paper is bifurcated into two parts.

0 kommentar(er)

0 kommentar(er)